effects of inflation on consumer prices explained

Anúncios

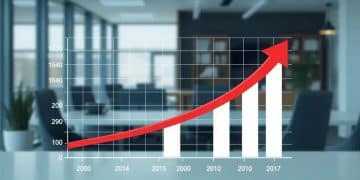

The effects of inflation on consumer prices result in increased costs for goods and services, which can erode purchasing power and significantly impact budgeting and savings strategies.

Effects of inflation on consumer prices can feel overwhelming. Have you ever wondered why your shopping cart feels lighter lately? This article delves into how inflation impacts what you pay for basics and luxuries alike.

Anúncios

Understanding inflation and its causes

Understanding inflation and its causes is essential for grasping how it affects your daily life. Inflation refers to the general increase in prices and the decline in purchasing power. When prices rise, each dollar buys fewer goods and services than before.

Several factors contribute to inflation. One of the primary causes is demand-pull inflation, which occurs when demand for goods surpasses supply. This situation often arises during economic growth when consumers are eager to spend money. Another critical factor is cost-push inflation, which happens when production costs increase, leading businesses to raise their prices.

Anúncios

The role of monetary policy

The central bank plays a significant part in controlling inflation. By adjusting interest rates, the bank influences borrowing and spending. Lower interest rates can stimulate the economy but may lead to higher inflation. Conversely, increasing rates can help cool down an overheating economy.

Main causes of inflation

- Demand-pull inflation: High demand from consumers drives prices up.

- Cost-push inflation: Rising costs of goods leads to higher consumer prices.

- Monetary policy changes: Central banks adjust rates affecting spending.

Another factor that can contribute to inflation is unexpected events, such as natural disasters or geopolitical conflicts. These occurrences can disrupt supply chains and lead to shortages, driving prices higher. Additionally, inflation can be influenced by market psychology as consumers anticipate future price increases and adjust their spending habits accordingly.

Understanding these elements is crucial for both consumers and businesses. It can help in making informed financial decisions. For example, if inflation is expected to rise, consumers might choose to make larger purchases now rather than later, while businesses might adjust their pricing strategies.

How inflation affects everyday purchases

Understanding how inflation affects everyday purchases is crucial for managing your finances. When inflation rises, the prices of goods and services increase, which can affect your budget and spending habits. Have you noticed your grocery bills getting higher? This is a direct consequence of inflation.

The impact of inflation can be seen across various sectors. For instance, when gas prices go up, not only does it affect your ability to fill up your car, but it can also lead to increased prices in delivery services and goods, as transport costs rise.

Impacts on essential items

Essential items like groceries and household products are often the first to feel the pressures of inflation. As these prices increase, families may need to adjust their purchasing choices. Here are some ways inflation affects these items:

- Prices for fruits and vegetables rising.

- Higher costs for bread and dairy products.

- Increased prices for personal care items.

These rising costs can force consumers to consider alternative options. For example, buying store brands rather than name-brand products might save money. Not everyone can afford these changes, making budgeting essential during times of inflation.

The effect on leisure activities

Inflation doesn’t just impact necessities. Leisure activities are also affected by rising costs. Going to the movies, dining out, or planning vacations can become more expensive. As disposable income shrinks due to inflation, families might find themselves cutting back on these activities. This can lead to a decrease in overall happiness, as entertainment is vital to social life.

Additionally, inflation can cause consumers to rethink their spending priorities. Instead of dining out frequently, people might choose to cook at home more often. This shift not only helps save money but also fosters healthier eating habits.

Long-term consequences of inflation on savings

The long-term consequences of inflation on savings can significantly impact your financial future. When inflation rises, the real value of your money decreases over time. This means that the purchasing power of your savings diminishes, making it harder to reach financial goals.

One of the primary effects of inflation on savings is the erosion of interest earnings. Many savings accounts offer low-interest rates, which often do not keep up with inflation. For instance, if your savings account earns 1% interest but inflation is at 3%, you are effectively losing money in terms of what you can buy with those savings.

Impact on investment decisions

As consumers become aware of the consequences of inflation, their investment decisions may change. Low-interest savings accounts may become less appealing, prompting individuals to explore alternative investment options. Here are some common responses:

- Investing in stocks or bonds that offer higher returns.

- Buying real estate as a hedge against inflation.

- Considering commodities like gold, which often hold value better during inflationary periods.

This shift illustrates how inflation can lead to a reevaluation of traditional savings methods, encouraging a more aggressive approach to protecting wealth.

Strategies to protect savings

There are ways to protect your savings against the effects of inflation. One effective approach is to invest in assets that typically appreciate in value, such as real estate or stocks. Creating a diversified investment portfolio can also help mitigate risks associated with inflation.

Moreover, utilizing inflation-protected securities can provide some peace of mind. These securities adjust their value based on inflation rates, ensuring that your investment keeps pace with rising prices. It’s important to stay informed about economic trends and adjust your savings strategy accordingly to safeguard your financial well-being.

Strategies to cope with rising prices

As inflation continues to rise, finding effective strategies to cope with increasing prices becomes crucial for managing personal finances. Adapting your budget and spending habits can help mitigate the impact of inflation on your daily life. There are practical ways to stretch your dollar further.

One essential strategy for tackling rising prices is to create a comprehensive budget. A budget allows you to track your income and expenses. By identifying where your money goes, you can find areas to cut back or adjust your spending.

Smart shopping habits

Developing smart shopping habits can make a significant difference. Start by making a shopping list before heading to the store. This practice helps you avoid impulse purchases that add unnecessary expenses. Additionally, consider utilizing coupons and taking advantage of sales. By doing so, you can save money on essential items.

- Plan meals for the week to minimize food waste.

- Buy in bulk for non-perishable items.

- Compare prices at different stores to find the best deals.

Another effective way to cope with rising prices is to consider alternative products. Generic or store-brand items often cost less than name brands but offer similar quality. This approach can lead to substantial savings over time. Moreover, when shopping for household essentials, consider local farmers’ markets for fresh produce, which can sometimes be more affordable than grocery stores.

Long-term financial planning

In addition to short-term strategies, it’s essential to think about long-term financial planning. Investing can be a powerful way to protect your wealth against inflation. Consider diversifying your investment portfolio with assets like stocks or real estate. These investments can appreciate over time, helping your money grow even as prices rise.

Join a savings plan that offers interest rates that keep up with or exceed inflation. Look into high-yield savings accounts or inflation-protected securities. Keeping your money working for you is essential during inflationary periods.

In summary, understanding the effects of inflation on consumer prices is vital for making informed financial decisions. By recognizing how rising prices influence savings and everyday purchases, you can implement effective strategies to cope with these challenges. Smart shopping, long-term financial planning, and adapting to changing market conditions will help you manage your finances better. Staying proactive and making adjustments can pave the way for a more secure financial future.

FAQ – Frequently Asked Questions about Inflation and Consumer Prices

What is inflation and how does it affect prices?

Inflation is the rise in prices over time, reducing purchasing power. This means that the same amount of money buys fewer goods and services.

How can I cope with rising prices?

To cope with rising prices, create a budget, shop smartly, buy in bulk, and consider investing in assets that may outpace inflation.

Why is it important to track my expenses?

Tracking expenses helps identify spending habits and areas where you can save. This can be vital during periods of high inflation.

What types of investments help protect against inflation?

Investments in stocks, real estate, and inflation-protected securities can help protect your savings from losing value due to inflation.